U.S. Stock Market Boom: S&P 500 Soars 216% in a Decade

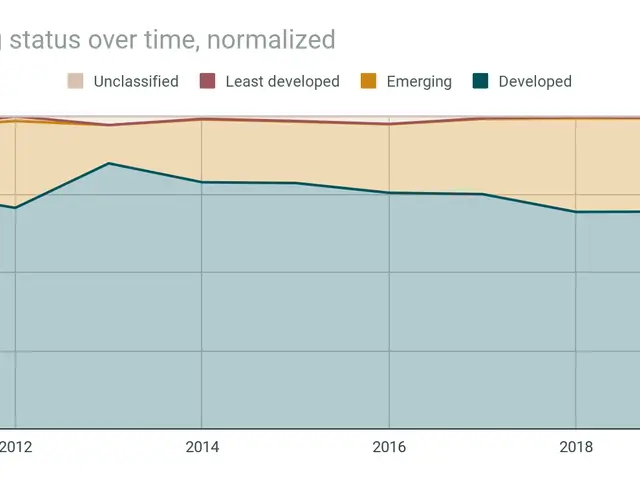

The U.S. stock market has seen strong growth over the past decade, with major indices delivering substantial returns. Three key benchmarks—the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average—have all climbed significantly, though at different rates. As of September 2025, around 5,500 companies trade on the New York Stock Exchange and Nasdaq, reflecting the market’s vast scale.

The S&P 500, which tracks 500 of the largest U.S. companies, rose by 216% over the last ten years. This translates to an average annual return of 12.1%. The index covers roughly 80% of the U.S. stock market by value, with tech firms like Nvidia, Apple, Microsoft, Alphabet, and Amazon playing a dominant role. Other major sectors include consumer staples, featuring companies such as Walmart, Costco, Coca-Cola, PepsiCo, and Procter & Gamble.

The past decade has been marked by rapid gains across major U.S. stock indices. However, future performance may not match these highs, with projections pointing to more modest returns. Investors will likely face a different market environment in the years to come.