Robinhood’s stock plunges 9.5% despite beating earnings expectations

Robinhood Markets saw its stock price drop sharply on Thursday, despite reporting strong third-quarter earnings. The decline came as broader market concerns weighed on investor sentiment, particularly around economic data and government instability.

By midday, shares had fallen by 9.5%, with no company-specific news triggering the selloff.

The company had earlier announced a 45% rise in revenue for Q3, beating earnings expectations. Yet, its stock price tumbled to $108.29 by the afternoon, down 8.35% on the day. Analysts noted that at 49 times earnings, the valuation remained steep compared to forecasts of 22% long-term growth.

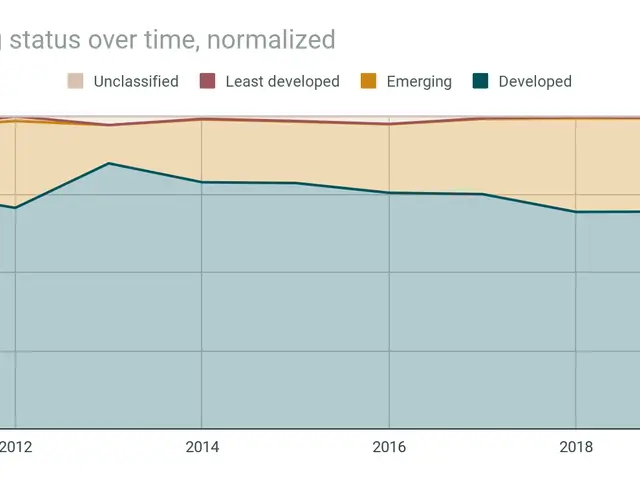

Meanwhile, the S&P 500 reversed early gains, slipping 0.8% as traders questioned the durability of the stock market. The U.S. Bureau of Labor Statistics then released stronger-than-expected jobs data for September, with 119,000 new positions—more than double predictions. This raised concerns that the Federal Reserve might delay stock market interest rate cuts, further pressuring stocks.

Nvidia’s strong earnings report had briefly lifted confidence in AI-related investments. But crypto-linked stocks, including Robinhood, faced heavier losses amid fears over economic conditions and a potential government shutdown affecting stock market liquidity. Some investors now view this as an opportune moment to exit positions in high-priced stocks like Robinhood, which holds a $106 billion market cap and an 89.78% gross margin.

Robinhood’s stock decline reflects broader market unease rather than company performance. With economic uncertainty and high valuations, investors are reassessing riskier assets. The company’s next moves will likely depend on how macroeconomic factors evolve in the coming weeks.