iShares IJJ Outperforms Peers in Mid-Cap Value Space

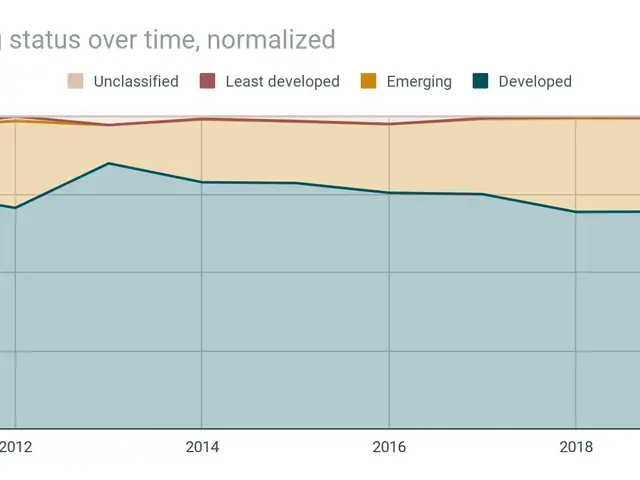

iShares S&P Mid-Cap 400 Value ETF (IJJ), launched on 24th July 2000, has shown impressive performance, closely matching the Vanguard Mid-Cap Value Index Fund ETF Shares (VOE). It tracks the S&P Mid-Cap 400 Value Index and has higher trading volumes than its peers.

IJJ holds 295 U.S. companies, with significant investments in financials (20.4%) and industrials (17.1%). Its top 10 holdings represent only 10.8% of assets, with the largest position at 1.52%. Despite having a higher total expense ratio of 0.18%, IJJ is cheaper than its benchmark based on valuation ratios. It offers a 30-day SEC yield of 1.86%.

IJJ's direct competitors are SPDR® S&P 400 Mid Cap Value ETF (MDYV) and Vanguard S&P Mid-Cap 400 Value Index Fund ETF Shares (IVOV). IJJ has outperformed its sister fund IJH by 83 basis points annually since 1st August 2000, with slightly higher risk.

IJJ's strong performance, diverse holdings, and higher trading volumes make it an attractive option for investors seeking exposure to mid-cap value stocks. Its competitive fees and outperformance against similar funds further enhance its appeal.