Europe’s Sewing Machine Industry Faces Automation and Reshoring Shifts by 2035

The EU’s industrial sewing machine market stands at a turning point. Long dominated by a few key producers, the sector now faces shifting demand and new challenges. Recent reports highlight how automation, sustainability rules, and production relocations are reshaping the industry.

Germany remains the clear leader in both production and exports of industrial sewing machines within the EU. Alongside France and Italy, these three countries form the core of the region’s manufacturing base. Together, they also drive over half of the EU’s demand for such equipment.

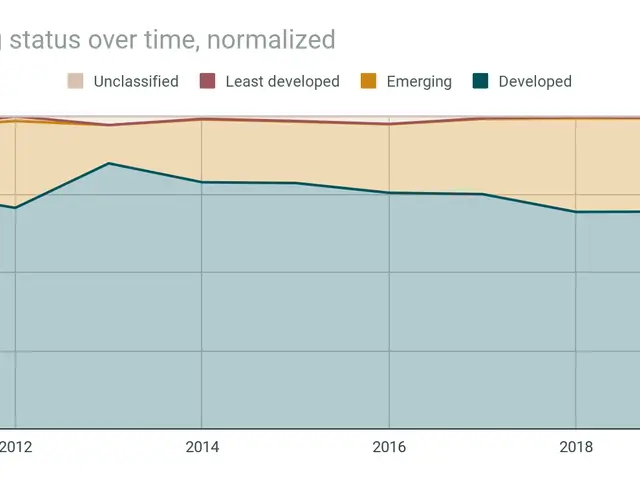

The market serves different needs, split by machine type, application, and technology. Each segment follows its own growth path, influenced by trends like automation and stricter environmental regulations. One major force behind demand is the move to bring textile and apparel production closer to home, pushing companies to invest in advanced machinery.

Exports from the EU outstrip imports by value, with Germany leading the way. However, the average export price per unit fell to $1,700 in 2024, reflecting competitive pressure and a shift in product mix. Meanwhile, imports tend to be cheaper, standardised machines from Asia, meeting demand for low-cost, basic production setups.

Looking ahead to 2035, no single European country is yet seen as a standout in producing highly automated, sovereign-focused sewing solutions. The market remains concentrated, with growth tied to how quickly manufacturers adapt to automation and sustainability demands.

The EU’s industrial sewing machine sector is evolving under pressure from automation, reshoring, and green policies. Germany, France, and Italy will continue to dominate production and demand, but competition and pricing challenges persist. Future growth will depend on how well manufacturers align with technological and sustainability trends in the coming decade.