Bitcoin's future splits analysts: $150K targets vs. lingering market doubts

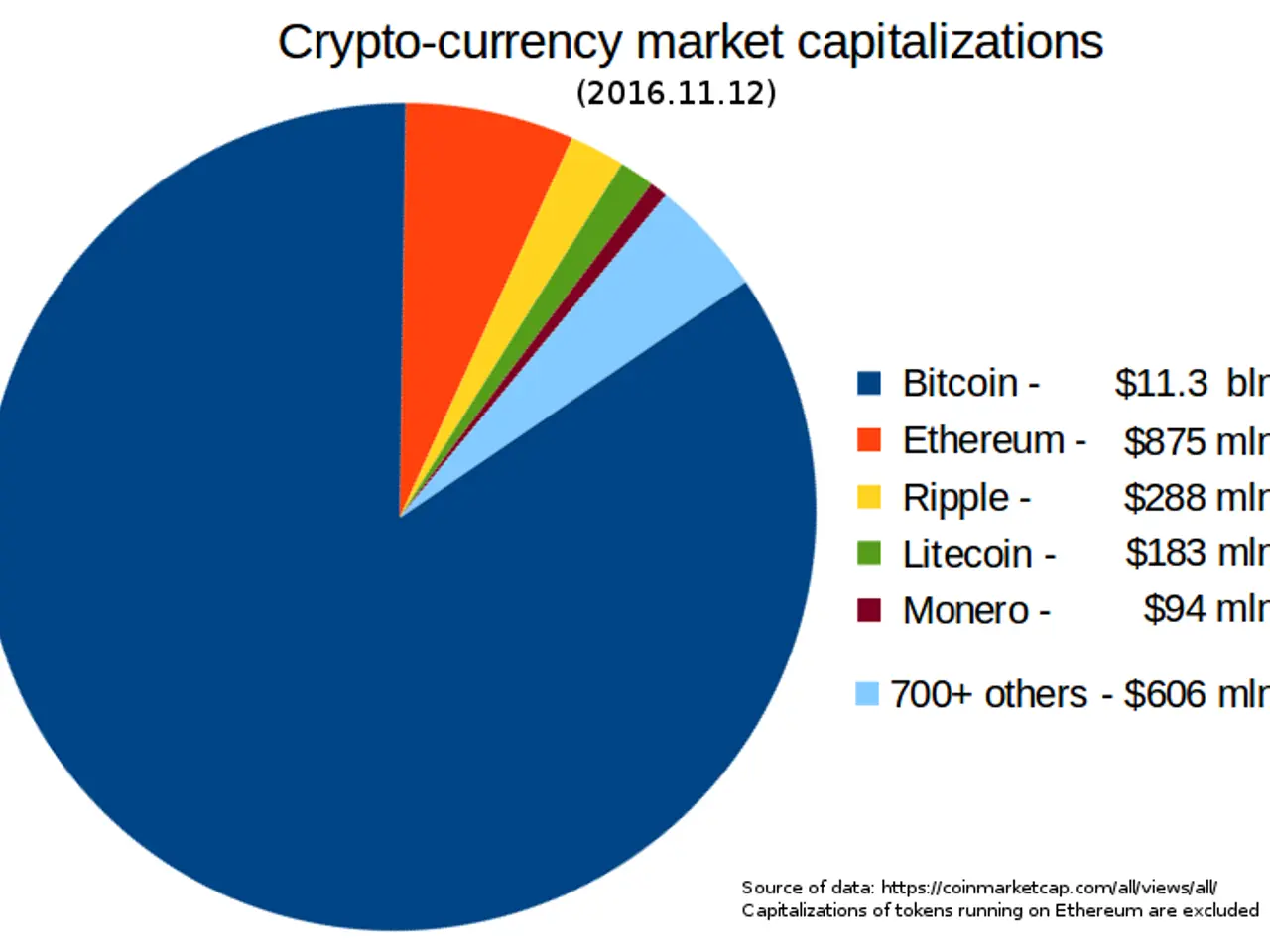

Bitcoin's price outlook has drawn fresh attention as analysts weigh historical trends and future projections of the Bitcoin price today. While some firms predict sharp gains, others highlight lingering uncertainty in market sentiment and institutional backing.

Bernstein analysts have reaffirmed a bold $150,000 target for Bitcoin, describing its recent slump as the 'weakest bear case' on record. The firm's stance contrasts with broader caution, as no major bank has openly endorsed Bitcoin as a long-term asset in the past two years.

Historical patterns offer mixed signals. Data shows Bitcoin closed higher in half of the last 24 months. If this trend continues, the cryptocurrency could climb to $122,000 within ten months. Analyst Timothy Peterson adds to the optimism, giving Bitcoin a near 90% chance of rising in value by early 2027. His model tracks the frequency of gains rather than their size, aiming to spot shifts in market direction.

Yet sentiment remains subdued. A recent survey by Peterson reveals low confidence among investors. Meanwhile, Wells Fargo expects $150 billion to flow into Bitcoin and stocks by late March, driven by growing savings and speculative interest.

The divide between bullish forecasts and cautious sentiment leaves Bitcoin's path unclear. Institutional support remains absent, but historical trends and fresh capital inflows could shape its trajectory in the coming months. Analysts continue to monitor both price movements and investor behaviour for clearer signals.